Loading

Get Ky Dor 42a740-s22 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY DoR 42A740-S22 online

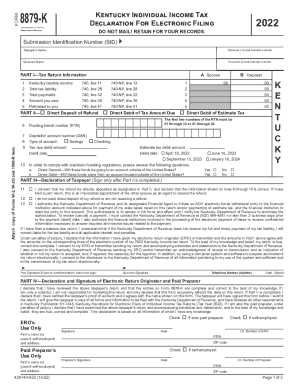

Filling out the KY DoR 42A740-S22 form online can be a straightforward process when guided step by step. This comprehensive guide will help users understand each section of the form and provide clear instructions for accurate completion.

Follow the steps to complete the KY DoR 42A740-S22 online.

- Press the ‘Get Form’ button to access the KY DoR 42A740-S22 form online in your preferred editor.

- Begin with the Submission Identification Number (SID) field; enter the 20-digit SID assigned to your tax return.

- Input the taxpayer's name and Social Security number accurately in the designated fields.

- If applicable, provide the spouse’s name and Social Security number.

- Proceed to Part I, where you must fill out your Kentucky taxable income, total tax liability, and total payments. Ensure that you complete either the amount you owe or the refund information.

- In Part II, select the appropriate preference for direct deposit of your refund and, if applicable, complete the direct debit information for tax amount due or estimated tax.

- Enter the routing transit number (RTN) and depositor account number. Ensure the RTN is valid and starts with the correct digits.

- Select the type of account (checking or savings) for the direct deposit or debit request.

- Fill in the amounts for tax due and estimated tax as necessary, along with the desired debit dates.

- In Part III, read the declarations carefully and sign the form only after verifying all information is correct. Include contact information where indicated.

- Finally, review the entire form for completeness and accuracy. Save your changes, and when ready, proceed to download, print, or share the form as needed.

Complete your KY DoR 42A740-S22 form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Kentucky has a 6.00 percent state sales tax rate and does not levy any local sales taxes. Kentucky's tax system ranks 18th overall on our 2023 State Business Tax Climate Index. Each state's tax code is a multifaceted system with many moving parts, and Kentucky is no exception.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.