Loading

Get Ky Dor 72a135 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY DoR 72A135 online

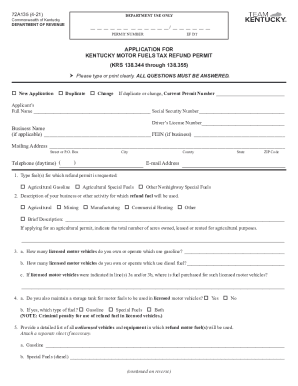

The KY DoR 72A135 is an important application form for obtaining a Kentucky motor fuels tax refund permit. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently, especially when filling it out online.

Follow the steps to complete the KY DoR 72A135 form online.

- Click 'Get Form' button to access the form and open it in your preferred online editor.

- Indicate whether this is a new application, duplicate, or change by selecting the appropriate checkbox. If applicable, enter the current permit number in the provided space.

- Fill in the applicant’s full name, social security number, and driver’s license number. If applying on behalf of a business, enter the business name and FEIN as well.

- Provide your mailing address, ensuring all fields are filled out correctly, including street or P.O. box, city, county, state, and zip code.

- Enter your daytime telephone number and email address for contact purposes.

- Select the type of fuel for which you are requesting a refund permit by checking the appropriate box for agricultural gasoline, agricultural special fuels, or other nonhighway special fuels.

- Describe your business or the activity for which the refund fuel will be used by checking the relevant box and providing a brief description if necessary.

- Provide information about the licensed motor vehicles you own or operate, entering the number of vehicles that use gasoline and diesel fuel in the specified fields.

- Indicate where fuel for the licensed motor vehicles is purchased by filling in the corresponding details.

- Answer questions regarding whether you maintain a storage tank for motor fuels and provide details on the tank type and fuel used.

- List unlicensed vehicles and equipment using the refund motor fuels, attaching a separate sheet if necessary.

- Estimate the number of gallons you will use each year for agricultural gasoline and special fuels and enter the amounts in the provided fields.

- List the details of each storage tank maintained for special fuels or gasoline, including tank type, size, location, and intended use.

- Confirm if all refund storage tanks are clearly marked, as required by law, selecting yes or no.

- Provide the name and address of the licensed distributor delivering your refund motor fuel.

- List any Kentucky tax account numbers assigned for various tax types and fill in the respective fields.

- Answer questions about previous Kentucky income tax filings, providing additional explanations if necessary.

- Finally, certify the accuracy of the information provided by printing your name, signing, and dating the application.

- Once completed, save changes to the form, and choose to download, print, or share it as needed.

Complete your application for the Kentucky motor fuels tax refund permit online today!

Related links form

Check Refund Status Online (Current Year Original Only) You must enter the exact refund amount in whole dollars only. To obtain a previous year(s) refund status, please call (502) 564-4581 to speak to an examiner. Prior year and amended return processing may require in excess of 20 weeks to complete.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.