Loading

Get Ny Ct-3-a/bc 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CT-3-A/BC online

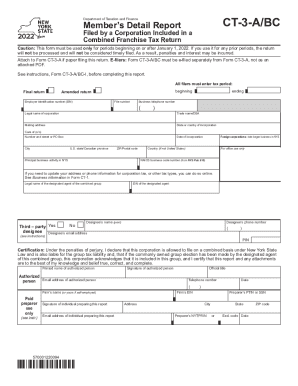

The NY CT-3-A/BC form is essential for corporations included in a combined franchise tax return in New York State. This guide will assist users in completing the form online with clear, step-by-step instructions.

Follow the steps to successfully fill out the NY CT-3-A/BC online.

- Press the ‘Get Form’ button to retrieve the NY CT-3-A/BC and open it in your preferred editor.

- Identify the tax period for which you are filing. Fill in the beginning and ending dates, and specify if this is a final or amended return.

- Enter the employer identification number (EIN) and file number in their respective fields. Also, provide your business telephone number.

- Fill in the legal name of the corporation, its mailing address, and if applicable, the trade name or doing business as (DBA) name.

- Provide the state or country of incorporation, the care of address, city, and U.S. state or Canadian province along with the ZIP/Postal code.

- Detail your principal business activity in New York State and, if you are a foreign corporation, include the date you began business in NYS.

- Complete the section for the designated agent of the combined group, including legal name, EIN, and contact details.

- Fill out the certification section, ensuring that the printed name and signature of the authorized person align with the declaration provided.

- Review Part 1 for general information, including questions about specific tax categories, and mark the appropriate boxes.

- Proceed to Part 2 to report your fixed dollar minimum tax and any prepayments you have made. Enter the relevant financial figures.

- In Part 4, provide detailed line items for your capital base at the beginning and end of the year, along with average values.

- For Part 5, compute the group member’s investment capital for the current tax year by entering required values.

- In Part 6, calculate the business apportionment factor for the year. Follow the prompts to fill in sales and income figures.

- Finalize the form by saving your changes. You can then download, print, or share the completed NY CT-3-A/BC as necessary.

Complete your NY CT-3-A/BC form online today for a seamless tax filing experience.

Form CT-3-S – Use the following address: NYS CORPORATION TAX. PO BOX 15182. ALBANY NY 12212-5182. Private delivery services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.