Loading

Get Ny It-213 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-213 online

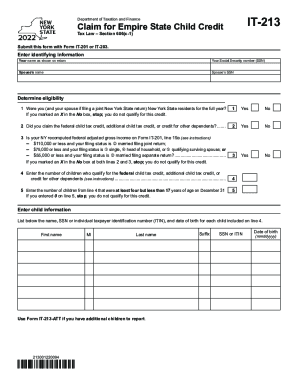

The NY IT-213 form is essential for claiming the Empire State Child Credit. This guide provides you with clear, step-by-step instructions to help you fill out the form accurately and efficiently online.

Follow the steps to complete your NY IT-213 form successfully.

- Press the ‘Get Form’ button to obtain the NY IT-213 form and open it in your preferred online editor.

- Enter your identifying information, including your name as it appears on your tax return and your Social Security number. Also include your spouse's name and their Social Security number if applicable.

- Determine your eligibility by answering the questions regarding residency and tax credits. If you do not qualify at any stage, you must stop filling out the form.

- Enter the number of children who qualify for the federal child tax credit. Additionally, specify how many of these children were aged four to 16 years on December 31.

- Provide detailed child information by listing each child's first name, middle initial, last name, Social Security number or ITIN, and date of birth.

- If applicable, complete Worksheets A, B, and C as instructed. Then calculate your credit based on the information provided.

- Enter results from the worksheets into the designated lines, ensuring whole dollar amounts only. Follow the calculations outlined on the form closely.

- If required, allocate amounts between spouses if you're filing separate returns.

- Once completed, review all information for accuracy. You can save changes, download a copy, print, or share the form as needed.

Start filling out your documents online today to ensure timely submissions.

The WFC Program offers up to $250 a year to families who qualify for the federal Earned Income Tax Credit (EITC) or California Earned Income Tax Credit (CalEITC). Families that qualify for both can get up to $9,600 for tax year 2022. Apply by April 18, 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.