Loading

Get Ca Ftb 3864 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3864 online

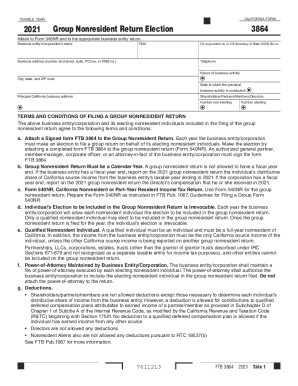

The CA FTB 3864 form is essential for business entities electing to file a group nonresident return in California. This guide provides clear, step-by-step instructions to help users fill out the form online accurately and efficiently.

Follow the steps to complete the CA FTB 3864 online form

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Enter the business entity’s or corporation’s name in the designated field.

- Provide the Federal Employer Identification Number (FEIN) associated with the business.

- Fill in the business address, including street number, suite, or postal box information.

- Input the CA corporation number or the California Secretary of State (SOS) file number.

- Record the primary telephone number for the business entity.

- Describe the nature of the business activity in the specified section.

- Complete the fields for city, state, and ZIP code.

- Indicate the state where the principal business activity is conducted.

- Provide the principal California business address of the entity.

- Fill in the number of non-electing shareholders, partners, members, or directors.

- Record the number of electing shareholders, partners, members, or directors.

- Read and agree to the terms and conditions of filing a group nonresident return by checking the appropriate box.

- Ensure that the authorized representative of the business entity signs the form, along with their title and date.

- After completing the form, save your changes, and choose to download, print, or share the completed form as required.

Complete your CA FTB 3864 form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.