Loading

Get Ca Schedule D (540) 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Schedule D (540) online

Filling out the California Schedule D (540) can seem daunting, but by following a clear and structured approach, you can navigate the process smoothly. This guide provides step-by-step instructions to help you complete the form online with confidence.

Follow the steps to complete your CA Schedule D (540) online.

- Click ‘Get Form’ button to retrieve the form and access it in your chosen online editor.

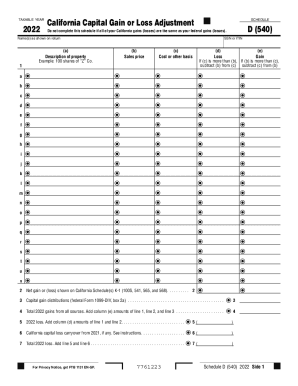

- Begin by entering your name as it appears on your tax return in the designated field. Ensure the name matches your federal tax documents.

- In column (a), provide a brief description of the property sold or exchanged, such as ‘100 shares of “Z” Co.’ This identifies the asset involved in the transaction.

- Next, input the sales price of the property in column (b). This is the amount you received from the sale.

- Fill out column (c) with the cost or other basis of the property, which includes the original purchase price and any adjustments.

- In column (d) and column (e), calculate and enter the loss or gain for each transaction. If the cost (c) is higher than the sales price (b), subtract the sales price from the cost to find a loss. If the sales price is higher, subtract the cost from the sales price to determine a gain.

- Complete line 2 by entering any net gain or loss shown on California Schedule(s) K-1 (100S, 541, 565, and 568). This accounts for additional gains or losses you may have.

- On line 3, include capital gain distributions as reported in federal Form 1099-DIV, box 2a. This adds to your total gains.

- Total your 2022 gains from all sources on line 4 by adding column (e) amounts from line 1, line 2, and line 3.

- Calculate your 2022 losses on line 5 by summing column (d) amounts from line 1 and line 2. This gives you the total losses for the year.

- If applicable, enter your California capital loss carryover from 2021 on line 6, following the related instructions.

- Total your 2022 losses on line 7 by adding line 5 and line 6 together.

- Combine the totals from line 4 and line 7 on line 8 to determine your net gain or loss. Depending on if you have a loss or gain, proceed to line 9 or line 10.

- If line 8 shows a loss, refer to line 9 and enter the smaller of either the loss on line 8 or $3,000 ($1,500 if married or partner filing separately).

- If there is a gain, enter the gain or loss from federal Form 1040 or 1040-SR, line 7, in line 10.

- On line 11, enter your California gain from line 8 or the loss from line 9, which will finalize your capital gain or loss for California purposes.

- For lines 12a and 12b, follow the prompts to identify the difference between lines 10 and 11 and enter the required amounts based on the given instructions.

- Review all entries for accuracy before finalizing your form. You can then save changes, download, print, or share your completed Schedule D (540).

Start completing your CA Schedule D (540) online today to ensure you meet your tax obligations efficiently.

A Purpose. Use Form 540-ES, Estimated Tax for Individuals, and the 2021 CA Estimated Tax Worksheet, to determine if you owe estimated tax for 2021 and to figure the required amounts. Estimated tax is the tax you expect to owe in 2021 after subtracting the credits you plan to take and tax you expect to have withheld.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.