Loading

Get Ca Ftb Schedule D-1 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB Schedule D-1 online

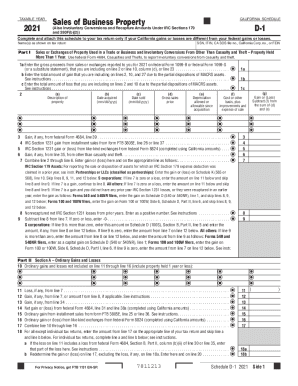

Filling out the CA FTB Schedule D-1 is an essential part of reporting your gains and losses related to business property sales in California. This guide provides a clear and supportive step-by-step approach to successfully completing this form online.

Follow the steps to complete the CA FTB Schedule D-1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name(s) as shown on your tax return along with your identification number (SSN, ITIN, or FEIN) in the designated field.

- In Part I, list the gross proceeds from sales or exchanges as reported to you for the year 2021 on relevant federal forms such as Form 1099-B or 1099-S. Fill in the amounts in their respective fields (1a, 1b, and 1c).

- Under section 2, provide details of the property sold, including its description, dates acquired and sold, gross sales price, and depreciation.

- Calculate the gain or loss by subtracting the depreciation from the sum of the gross sales price and any additional allowed costs. Enter this in the designated field.

- Proceed to report any ordinary gains and losses in Part II. This includes any properties held for one year or less. Again, provide necessary details like description, dates, sales prices, and costs.

- If applicable, complete Part III to report dispositions under IRC Sections 1245, 1250, 1252, 1254, and 1255. Follow the exact fields for each property you need to report.

- In Part IV, enter any recapture amounts associated with depreciation if the business use of assets has dropped below 50%. Make sure to follow provided instructions closely.

- Review all your entries for accuracy and completeness. Once satisfied, you can save your changes, download the form, print it, or share it as needed.

Start filling out your CA FTB Schedule D-1 online today to ensure accurate reporting and compliance.

Gains or losses from the sale or disposition of assets previously subject to the IRC Section 179 expense deduction are to be reported on Form 565, Partnership Return of Income; Form 568, Limited Liability Company Return of Income; or Form 100S, California S Corporation Franchise or Income Tax Return, and on the ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.