Loading

Get Tx Comptroller 00-750 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 00-750 online

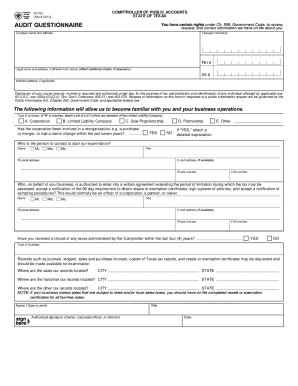

The TX Comptroller 00-750 form, also known as the Audit Questionnaire, is essential for individuals and businesses to provide relevant information for tax administration. Completing this form online is a straightforward process that ensures your details are correctly submitted for taxation purposes.

Follow the steps to efficiently complete the form online.

- Use the ‘Get Form’ button to access the TX Comptroller 00-750 form and open it in the editing interface.

- Begin by entering your taxpayer name and address in the designated fields. If your legal name and address differ from what is provided, ensure to fill out those details in the corresponding section.

- Provide your taxpayer number(s) and Federal Employer Identification Number (FEI #), ensuring accuracy to avoid any processing issues.

- Identify the type of business by selecting the appropriate box (A. Corporation, B. Limited Liability Company, C. Sole Proprietorship, D. Partnership, E. Other). If you indicate Limited Liability Company, remember to list the LLC members on an additional sheet if necessary.

- If your business has undergone any reorganization, such as a merger or name change in the last seven years, check ‘YES’ and attach a detailed explanation.

- Fill in the contact person's details for the examination process, including their name, title, email address, physical address (if available), phone number, and FAX number.

- Designate an authorized representative who can enter into agreements regarding tax assessments and provide their corresponding contact information.

- Address whether you have received any tax refunds from the Comptroller in the past four years, selecting ‘YES’ or ‘NO’ as applicable.

- Provide the locations of your sales tax, franchise tax, and other records, ensuring to specify the city and state for each.

- After completing all sections, verify that all information is accurate, then proceed to save your changes. You will have options to download, print, or share the completed form as needed.

Complete your TX Comptroller 00-750 form online today for a more efficient tax administration experience.

Higher reported sales Gross sales reported is the single biggest driving factor in the audit selection process. It is simple math: the higher your reported sales, the higher your potential tax exposure. The Comptroller knows this, so they audit larger businesses on a more regular basis.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.