Loading

Get Irs 56 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 56 online

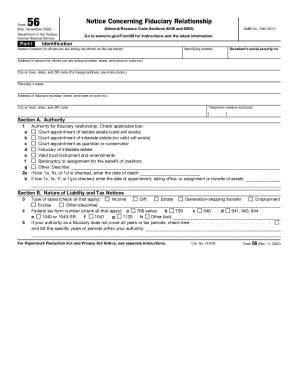

The IRS 56 form is essential for individuals acting as fiduciaries in various financial situations, ensuring proper communication with the Internal Revenue Service. This guide provides step-by-step instructions for users to efficiently complete and submit the form online.

Follow the steps to successfully complete the IRS 56.

- Press the ‘Get Form’ button to access the IRS 56 form and open it in your chosen editor.

- Enter the identification information in Part I, including the name of the person for whom you are acting, their social security number, and address. This ensures the IRS has the correct information regarding the fiduciary relationship.

- In Section A, indicate the authority for the fiduciary relationship by checking the relevant box, such as court appointment or valid trust. This establishes your legal authority.

- If applicable, enter the date of death or the date of appointment in the fields provided, depending on which authority box you checked. This is important for the IRS's records.

- In Section B, check all applicable boxes regarding the type of taxes related to the fiduciary's responsibilities. This may include income, estate, or excise taxes.

- List the federal tax form numbers associated with the fiduciary relationship in the specified section. Accurate entry here helps to clarify the scope of tax obligations.

- If the fiduciary authority only covers specific years, check the necessary box and detail the years or periods of authority. This precision aids the IRS in understanding the timeline of your fiduciary role.

- If you are revoking or terminating previous notices, complete the relevant sections in Part II, indicating the reason for termination and checking applicable boxes.

- For new fiduciaries, provide their names and addresses in the Substitute Fiduciary section if applicable, ensuring continuity in fiduciary duties.

- Fill in the details of any court or administrative proceedings in Part III if relevant to your fiduciary responsibilities.

- Finally, sign the form in Part IV, confirming under penalties of perjury that the information is true and accurate. Include the date and your title if applicable.

- Once all information is completed, you can save changes, download a copy, print, or share the form as required.

Start completing your IRS 56 online today to ensure proper fiduciary management.

You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903. Give notice of qualification under section 6036.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.