Loading

Get Irs 1065 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1065 online

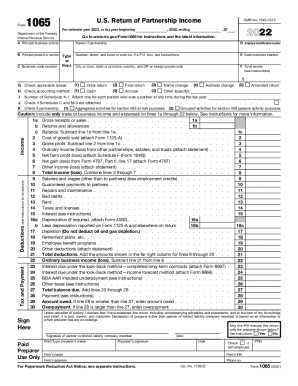

Filing the IRS 1065 form is essential for partnerships to report their income, deductions, and other tax-related information accurately. This guide will provide clear, step-by-step instructions on how to complete the form online, ensuring users understand each component of the document.

Follow the steps to fill out the IRS 1065 form online effectively.

- Click the ‘Get Form’ button to obtain the IRS 1065 form and open it for editing.

- Enter the name of the partnership and the Employer Identification Number (EIN) as requested in the designated fields.

- Fill out the business address, including the number, street, suite number, city, state, and ZIP code.

- Provide the principal business activity and the principal product or service offered by the partnership.

- Indicate the date the business started and check appropriate boxes for information regarding the return type, such as initial return or amended return.

- Select the accounting method used by the partnership from cash, accrual, or other options specified.

- Fill out the income section, starting with gross receipts or sales and deducting returns and allowances to find the balance.

- Report the cost of goods sold and calculate gross profit by subtracting the cost from total income.

- Complete the deductions section, including expenses like salaries, rent, interest, and other related costs.

- Calculate ordinary business income or loss by subtracting total deductions from total income.

- Complete the partnership representative section, providing the necessary information for the designated individual.

- Review all entered information for accuracy. Save changes, and when ready, download, print, or share the completed form.

Ready to file your documents online? Start the process today.

Certain nondeductible expenses, such as penalties and fines, and other nondeductible expenses entered on the bottom of the INC screen, in the Form 1065, Schedule K – Most Common Items section or the second K screen (go to the screen K and press Page Down), line 18c.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.