Loading

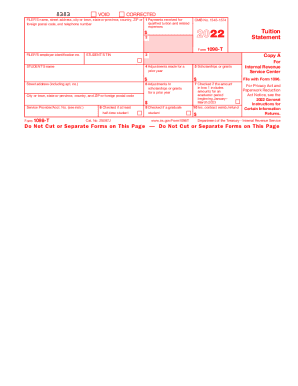

Get Irs 1098-t 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1098-T online

Filling out the IRS 1098-T form online is an essential step for students and educational institutions to report qualified tuition and related expenses. This guide provides detailed, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to fill out the IRS 1098-T form online.

- Click the ‘Get Form’ button to access the IRS 1098-T online form and open it in an editing interface.

- Enter the filer's name, address, and contact information in the designated fields. Ensure that this information accurately reflects the educational institution or individual providing the information.

- Provide the FILER’S employer identification number in the corresponding field to identify the institution filing the form.

- Input the student's taxpayer identification number (TIN) in the designated box to identify the recipient of the tuition information.

- Fill in the student's name and address, including any apartment number, along with the city, state, and ZIP code.

- In Box 1, report the total payments received for qualified tuition and related expenses during the year.

- Complete Box 5 with the total amount of scholarships or grants processed by the institution, as this may affect tax credits for the student.

- If applicable, enter adjustments to scholarships or grants for a prior year in Box 6, noting how it may influence the previous year’s tax claims.

- Check the appropriate boxes if the student qualifies as at least a half-time student or is a graduate student, as indicated in Boxes 8 and 9.

- Finally, review all filled information thoroughly; once confirmed, save the changes, download, print, or share the completed form as necessary.

Complete your IRS 1098-T form online today and ensure accurate reporting of your educational expenses.

The Form 1098-T is a statement that colleges and universities are required to issue to certain students. It provides the total dollar amount paid by the student for what is referred to as qualified tuition and related expenses (or “QTRE”) in a single tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.