Loading

Get Irs 709 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 709 online

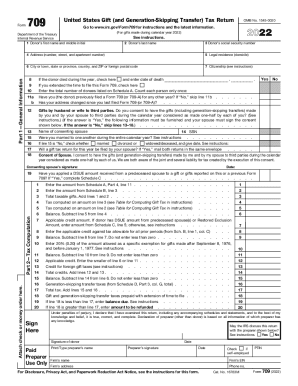

Filling out the IRS 709 is an important step for individuals making significant gifts or generation-skipping transfers. This guide provides clear and accessible instructions to help users navigate the online version of this form with confidence.

Follow the steps to complete the IRS 709 accurately.

- Click ‘Get Form’ button to obtain the IRS 709 and open it in your online editor.

- Begin by entering the donor's details in Part 1, including first name, last name, social security number, and address. Ensure all personal information is accurate and up to date.

- Indicate the legal residence and citizenship status of the donor. Make sure to follow any specific instructions related to these fields.

- If applicable, check whether you have extended the time to file and list the total number of donees in Schedule A.

- Address questions regarding previous filings of IRS 709 and any address changes since the donor's last filing.

- For couples, indicate if you wish to split gifts with your spouse and complete the necessary fields to do so, including obtaining your spouse's consent.

- Proceed to Part 2 for tax computation. Fill out the applicable lines based on the calculations from Schedule A, including total taxable gifts.

- In Schedule A, accurately document all gifts made during the year, including details such as donee names, gift descriptions, value at date of gift, and any relevant exemptions.

- Complete any additional schedules required, such as Schedule B for gifts from prior periods and Schedule C for deceased spousal unused exclusion amounts.

- Once all parts are filled, review the entire form to ensure accuracy. Save your changes, and finalize your filing by downloading, printing, or sharing the completed form as needed.

Prepare your documents online and complete the IRS 709 form with ease.

You may need to file a gift tax return If you make a taxable gift (one in excess of the annual exclusion), you are required to file Form 709: U.S. Gift (and Generation-Skipping Transfer) Tax Return. The return is required even if you don't actually owe any gift tax because of the $12.06 million lifetime exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.