Loading

Get Irs 1098 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1098 online

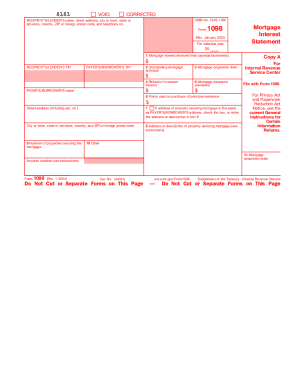

The IRS 1098 form, also known as the Mortgage Interest Statement, is an important document for reporting mortgage interest and related information to the Internal Revenue Service. This guide will provide you with clear, step-by-step instructions on how to fill out the IRS 1098 online, ensuring that you accurately complete this vital form.

Follow the steps to fill out the IRS 1098 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the recipient's or lender's name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number in the designated fields.

- Input the taxpayer identification number (TIN) for the recipient/lender and the payer/borrower in the respective areas of the form.

- In box 1, enter the total mortgage interest received from the payer or borrower during the tax year. This amount must include only the eligible interest and not any points or refunds.

- Fill in box 2 with the outstanding mortgage principal as of January 1 of the current year, or the date of origination if the mortgage began in the year.

- Specify the mortgage origination date in box 3.

- If applicable, enter any refund of overpaid interest in box 4. Remember that this amount should not be deducted.

- Input any mortgage insurance premiums in box 5, if they apply.

- In box 6, indicate the points paid on the purchase of the principal residence that are required to be reported.

- If the property securing the mortgage is the same as the payer/borrower’s address, check the box in box 7; otherwise, in box 8 provide the address or description of the property securing the mortgage.

- Include the number of properties securing the mortgage in box 9.

- Utilize box 10 to provide any other relevant information such as real estate taxes or insurance paid from escrow, if necessary.

- Finally, review all the entries for accuracy, save your changes, then download, print, or share the form as needed.

Complete your IRS 1098 form online to ensure a smooth filing process and avoid penalties.

Use Form 1098, Mortgage Interest Statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or business from an individual, including a sole proprietor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.