Loading

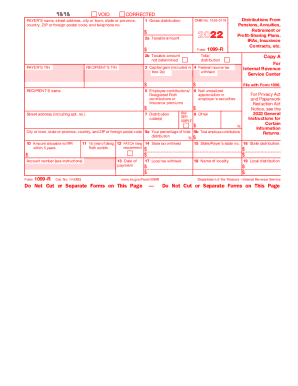

Get Irs 1099-r 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-R online

Filling out the IRS 1099-R form is essential for reporting distributions from various retirement plans, such as pensions and IRAs. This guide provides clear instructions to help you complete the form online efficiently and accurately.

Follow the steps to complete your IRS 1099-R form online.

- Click ‘Get Form’ button to access the 1099-R form and load it in your online editor.

- Enter the payer's name and address in the designated fields, ensuring all details are accurate and up-to-date.

- Fill in the payer's taxpayer identification number (TIN) and the recipient's TIN to complete the identification process.

- Provide the recipient's name and address, making sure to include any applicable information such as apartment numbers.

- In box 1, enter the total amount distributed during the year, accurately reflecting the gross distribution.

- Indicate the taxable amount in box 2a; if this amount is not determined, check box 2b accordingly.

- Document any federal income tax withheld in box 4, as this is crucial for your tax return filings.

- Review the distribution codes in box 7 to categorize the type of distribution properly.

- Complete any additional sections pertinent to your specific situation, including employee contributions, state distribution details, and local tax information.

- Once all fields are filled, you can save changes, download, print, or share the completed form as required.

Ready to file your IRS 1099-R form online? Take action now and complete the process efficiently.

Yes, you can still file taxes without a W-2 or 1099. Usually, if you work and want to file a tax return, you need Form W-2 or Form 1099, provided by your employer. If you did not receive these forms or misplaced them, you can ask your employer for a copy of these documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.