Loading

Get Va Dot 760py 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 760PY online

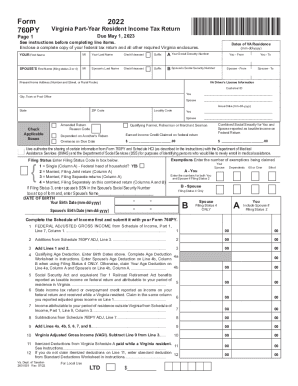

The VA DoT 760PY form is essential for individuals who are part-year residents of Virginia and need to file their income tax returns. This guide provides comprehensive steps to fill out the form online, ensuring clarity and support for users with varying levels of experience.

Follow the steps to complete your VA DoT 760PY form.

- Click ‘Get Form’ button to obtain the VA DoT 760PY form and open it in your editor.

- Begin by entering your information in the personal details section. Fill in your first name, middle initial, last name, and check the box if you are deceased. Include your social security number and the relevant dates of Virginia residence.

- Complete the spouse's information if applicable. If you are filing jointly, ensure to include their first name, last name, middle initial, social security number, and confirm if they are deceased.

- Provide your home address details clearly, including your street number, town, state, and ZIP code.

- In the filing status section, enter the applicable filing status code based on your circumstances, such as 'Single', 'Married Filing Joint', or others specified.

- List the exemptions being claimed for both you and your spouse as appropriate, remembering to include birth dates for age-related deductions.

- Proceed to calculate your Virginia adjusted gross income by filling out the income and deductions sections as directed. Use the figures from your federal tax return and any required schedules.

- After calculating your taxable income, complete the tax amount section based on the Virginia tax table guidelines.

- List all income tax withholdings, estimated payments, and credits. Ensure all relevant forms and documents are attached as instructions indicate.

- Lastly, review your completed form for accuracy and ensure both you and your spouse sign where indicated. Include your bank details if you wish to receive a refund via direct deposit.

- Once you have verified all information, save your changes, download, print, or share the completed form as necessary.

Complete your VA DoT 760PY form online today for an efficient filing process.

How much is the self employment tax for Virginia? The Virginia self employment tax covers Social Security and Medicare payments when you work for yourself. The total is 15.3%, with 12.4% covering Social Security and 2.9% covering Medicare.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.