Loading

Get Ca Uben 106 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA UBEN 106 online

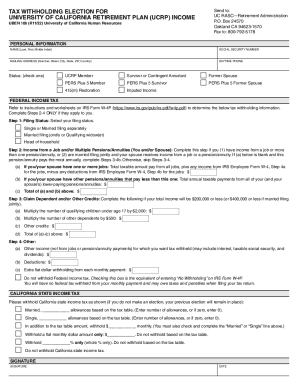

The CA UBEN 106 form is essential for electing or changing tax withholding for University of California Retirement Plan income. This guide provides clear, step-by-step instructions to help you complete the form correctly online.

Follow the steps to fill out the CA UBEN 106 form online

- Press the ‘Get Form’ button to obtain the CA UBEN 106 form and open it in the editor.

- Begin by entering your personal information in the designated fields, including your name, Social Security number, mailing address, and daytime phone number. Make sure all information is accurate and complete.

- Select your status by checking the appropriate box. Options may include UCRP member, survivor or contingent annuitant, former spouse, and others. Ensure you choose the role that corresponds to your situation.

- Provide your federal income tax withholding information. Follow the prompts related to filing status. Choose from options like single, married filing jointly, or head of household. Complete additional steps based on your income sources if applicable.

- For California state income tax, indicate the number of allowances you wish to claim. Enter a flat amount if preferred, or select options for withholding based on the tax table.

- Review all sections for accuracy. Check the box for no federal tax withholding if you choose that option and remember that this may lead to taxes owed later.

- Sign and date the form to validate your choices and ensure it is submitted correctly. Make sure to keep a copy for your records.

- Once complete, you can save the changes to your document, download it, print it for mailing, or share it as required.

Complete your CA UBEN 106 form online to ensure your tax withholding is managed effectively.

You may not have to withhold if: Total payments or distributions are $1,500 or less. Paying for goods. Paying for services performed outside of California.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.