Loading

Get Va Dot 502 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 502 online

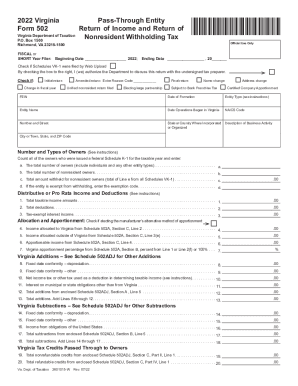

Filling out the VA DoT 502 form is essential for reporting income and nonresident withholding tax for pass-through entities in Virginia. This guide provides a clear, step-by-step approach to help users complete the form accurately and confidently.

Follow the steps to successfully complete your VA DoT 502 form.

- Click 'Get Form' button to access the VA DoT 502 form and open it in your preferred editor.

- Begin by entering the fiscal or short year filer dates in the fields provided for the beginning and ending dates of the filing period. Ensure that you check the appropriate boxes for the type of return you are submitting, such as Initial return or Amended return, as applicable.

- Fill in your entity's details, including the FEIN (Federal Employer Identification Number), date of formation, entity type, name, and address. Provide the NAICS code and a description of the business activity.

- Identify and count the number of owners for the taxable year. This includes both individuals and entities who were issued a federal Schedule K-1. Make sure to indicate the total number of owners and the number of nonresident owners, along with the total amount withheld for nonresident owners.

- Complete the income and tax sections by entering the total taxable income, deductions, and any applicable tax credits. Follow the instructions for claiming additional subtractions or additions as outlined in the form.

- If applicable, complete the withholding payment reconciliation section. Fill in the total withholding tax due, total withholding tax paid, and any overpayment adjustments.

- Review your entries for accuracy and completeness. Check that all required fields are filled and that you have signed the form in the designated section.

- Once you have verified all information, you can save changes, download the completed form, print a hard copy, or share it as needed.

Complete your VA DoT 502 form online today to ensure timely and accurate filing.

eForm 502W lets you make withholding payments directly from your PTE's checking account. ACH credit is available for tax due payments or withholding payments if paying separately from filing the return. You'll need to set this up with your PTE's bank.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.