Loading

Get Irs 8865 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8865 online

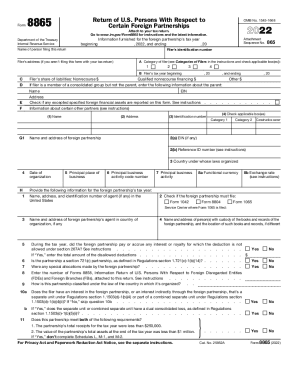

This guide provides clear and concise instructions for completing the IRS Form 8865, which is used to report information regarding certain foreign partnerships. Whether you are experienced in digital document management or a beginner, this guide will support you through the process of filling out the form online.

Follow the steps to complete the IRS 8865 online effectively.

- Click ‘Get Form’ button to access the IRS Form 8865, enabling you to begin your online filing process.

- Enter the required information for the tax year of the foreign partnership, including the starting and ending dates. Ensure accuracy to prevent any issues down the line.

- Provide your name and identification details in the appropriate fields. This includes your tax identification number and address, if you are not submitting the form with your tax return.

- Indicate the category of filer by checking the corresponding boxes. Review the categories in the instructions to determine which applies to you.

- Fill in the details about the foreign partnership, including its name, address, and identification number. It is important to have this information readily available.

- Complete the financial information section, detailing your share of the partnership's liabilities and any other relevant financial data.

- If applicable, answer questions regarding certain obligations or transactions between the partnership and its partners. Be thorough in your responses to ensure proper reporting.

- After filling out all necessary sections and double-checking your entries for accuracy, save your changes. You will then have the option to download, print, or share the completed form as needed.

Complete your IRS 8865 form online today to ensure compliance and accuracy in your tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When a person owns a percentage of a foreign partnership, they may also need to report it on Form 8938… unless they meet the threshold requirement of having to file form 8865. In that case, the individual will file a form 8865 instead of Form 8938 as to that particular interest in the foreign partnership.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.