Loading

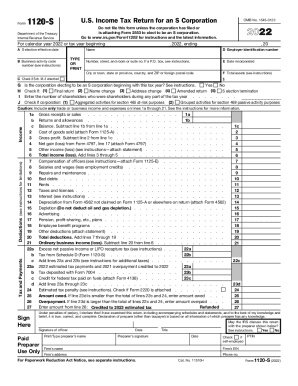

Get Irs 1120s 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120S online

Filing the IRS 1120S form for an S Corporation can be a straightforward process when approached step by step. This guide provides detailed instructions to help you navigate and complete the form effectively online.

Follow the steps to fill out the IRS 1120S online

- Click ‘Get Form’ button to obtain the form and open it in your document editor.

- Begin by entering the corporation's details at the top of the form, including the name, Employer Identification Number (EIN), and business address.

- Specify the tax year for which the return is being filed, and indicate if the S election is effective starting from this tax year.

- Proceed to report income by filling out lines related to gross receipts, returns and allowances, cost of goods sold, and other income sources as instructed.

- Include deductions by detailing compensation of officers, salaries and wages, rents, taxes, and other relevant expenses according to the provided guidelines.

- Calculate the total income or loss, then indicate any taxes due or overpayments, such as credit for federal tax paid on fuels if applicable.

- Review and complete the schedule sections, including Schedule B for additional information, and attach any necessary forms if indicated.

- Finally, ensure the form is signed by an authorized officer of the corporation, then save your changes and prepare to submit.

- You can save, download, print, or share the completed form as needed.

Complete your IRS 1120S filing online today to stay compliant.

When S corporations fail to file Form 1120S by the due date or by the extended due date, the IRS will impose a minimum penalty of $210 for each month or part of the month the return is late multiplied by the number of shareholders for 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.