Loading

Get Nc Dor D-403 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR D-403 online

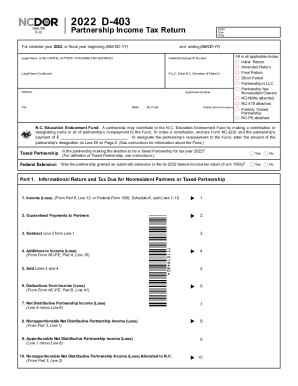

The NC DoR D-403 form is essential for partnerships to report income, deductions, and tax obligations to the North Carolina Department of Revenue. This guide will provide you with clear instructions on how to fill out the D-403 online, ensuring accuracy and compliance.

Follow the steps to successfully complete the NC DoR D-403 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the legal name of the partnership in capital letters, followed by the Federal Employer ID Number. If your partnership is an LLC, also include the North Carolina Secretary of State ID.

- Provide the complete address, including apartment number, city, county (first five letters), state, and zip code.

- Select all applicable options by marking the circles for initial returns, amended returns, final returns, and any other categories that apply to your partnership.

- Indicate whether the partnership is making the election to be a taxed partnership for the tax year and if an automatic extension was granted for filing the federal income tax return.

- Fill out Part 1 regarding the informational return and income details. Enter income or loss and subtract guaranteed payments to partners as instructed on lines 1-3.

- Continue detailing additions and deductions to income on lines 4-6, then calculate net distributive partnership income (loss) as indicated.

- If applicable, fill out the tax due for nonresident partners or taxed partnerships in the subsequent lines as directed.

- Complete the remainder of the form by following the instructions for any payments due or overpayments that apply.

- Review all the entered information carefully to ensure accuracy and completeness before proceeding to save changes.

- Once finished, save and download your completed form, or print and share it as required.

Get started on filing your NC DoR D-403 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The NCDOR officially began issuing 2022 Individual Income Tax refunds on Friday, March 10. Taxpayers may begin receiving refunds through the mail and direct deposit next week. Raleigh, N.C. The North Carolina Department of Revenue (NCDOR) officially began issuing 2022 Individual Income Tax refunds on Friday, March 10.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.