Loading

Get Va Form Rdc 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form RDC online

Filling out the VA Form RDC online can streamline the application process for the Research and Development Expenses Tax Credit. This guide will provide clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the VA Form RDC online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

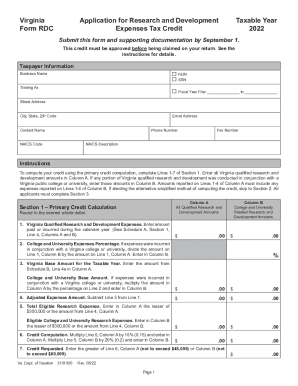

- Begin by entering your taxpayer information in the designated fields, including the business name, FEIN, SSN, and trading name. Ensure that the street address, city, state, and ZIP code are also accurately filled in.

- Next, complete Section 1 for primary credit calculation. Input all Virginia qualified research and development amounts in Column A. If any expenses were associated with a Virginia college or university, enter those amounts in Column B.

- Continue filling in Lines 1-7 of Section 1, ensuring all values are rounded to the nearest whole dollar. Pay close attention to the computations based on your eligibility, particularly regarding the percentage credit calculation.

- If you are electing the alternative simplified method, skip to Section 2 and follow similar steps for entries in Columns A and B as specified. Complete all appropriate fields and calculations.

- In Section 3, provide additional credit information, including the number of full-time employees, total gross receipts for the taxable year, and details on any college or university involvement.

- Review the entire form for accuracy and completeness. Once satisfied, save changes, download a copy for your records, or print the form for submission.

Complete the VA Form RDC online today to apply for your Research and Development Expenses Tax Credit.

What is it? An income tax credit equal to 50% of the qualified investments you made to qualified businesses during the year. You can claim a credit of up to $50,000 on your return, not to exceed your tax liability. Carry forward any unused credits for 15 years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.