Loading

Get Irs 1120s - Schedule K-1 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120S - Schedule K-1 online

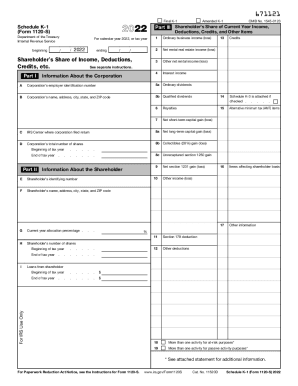

Filling out the IRS 1120S - Schedule K-1 accurately is essential for reporting income, deductions, and credits for shareholders of S corporations. This guide provides step-by-step instructions to assist users in completing the form online.

Follow the steps to successfully complete the IRS 1120S - Schedule K-1.

- Click ‘Get Form’ button to acquire the Schedule K-1 document and open it in your preferred online editor.

- Begin with Part I, where you will enter the corporation's information, including the employer identification number, name, address, and the IRS center where the corporation filed its return.

- Proceed to Part II to fill in your personal information as a shareholder. This includes your identifying number, name, address, and the current year allocation percentage.

- In Part III, accurately report your share of current year income, deductions, credits, and other items. Pay attention to specific fields such as ordinary business income, rental income, dividends, and interest income.

- As you fill out each section, ensure that you input amounts correctly, matching them with the information provided by the corporation.

- If applicable, check the box if Schedule K-3 is attached and complete any additional information requested in the provided fields.

- Once you have filled out all necessary fields and reviewed for accuracy, you can save your changes, download, print, or share the completed Schedule K-1 form as needed.

Complete your documents online to ensure timely and accurate filing.

Schedule K-1, Form 1120S, you receive should only reflect your share of income, deductions and expenses as applicable....If you received a Schedule K-1 (Form 1120S) as a shareholder, to make the entry, go to: Federal Section. Income -Select My Forms. Less Common Income. K-1 Earnings. Schedule K-1 Form 1120S.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.