Loading

Get Ca Ftb 3500 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3500 online

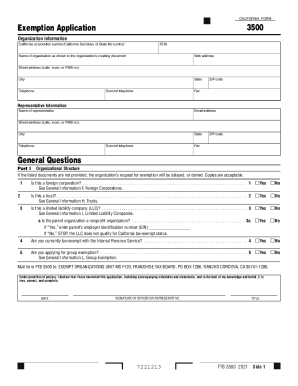

The California Franchise Tax Board (FTB) Form 3500 is used for organizations to apply for tax exemption. Filling out this form online can simplify the process, allowing users to easily submit their application for consideration.

Follow the steps to complete the CA FTB 3500 online.

- Press the ‘Get Form’ button to access the CA FTB 3500 form and open it in your preferred online editor.

- Enter the organization information, including California corporation number or Secretary of State file number, Federal Employer Identification Number (FEIN), and the name of the organization exactly as it appears in the creation document.

- Provide the web address, street address, city, state, telephone numbers, and fax number of the organization.

- Fill out the representative information by providing their name, email address, street address, city, state, telephone numbers, and fax number.

- Answer the general questions regarding the organizational structure, such as whether the organization is a foreign corporation, a trust, or a limited liability company (LLC), and provide additional details as necessary.

- Complete the narrative of activities section by detailing the organization’s purpose, the date of formation, and any current or planned activities.

- Fill out the financial data section that inquires about previously filed forms and requests financial statements if applicable.

- List details of all officers, directors, and trustees, including names, titles, mailing addresses, and compensation amounts.

- Provide any history related to California ID numbers and previous exemption status from both California and the IRS.

- Fill out any additional sections regarding specific activities and whether the organization engages in fundraising, gaming, or other similar activities.

- Once all sections are properly filled out, review the entire form for accuracy before submitting.

- Save changes, download, print, or share the completed form as needed.

Complete your CA FTB 3500 form online now to ensure your organization gets the tax exempt status it deserves.

Related links form

© 2023 California Franchise Tax Board.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.