Loading

Get Irs Instructions Schedule A (990 Or 990-ez) 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions Schedule A (990 or 990-EZ) online

Filling out the IRS Instructions Schedule A is an essential step for organizations seeking to maintain their public charity status. This guide provides clear and concise steps to assist users in completing the form online, ensuring compliance with IRS regulations.

Follow the steps to effectively complete Schedule A online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Understand the sections of the form including Part I, which identifies the reason for public charity status. Review the categories carefully and select the one that aligns with your organization's status.

- Complete Part II, the Support Schedule, by entering the appropriate dollar amounts for support from various sources such as governmental agencies and general public contributions.

- Proceed to Part III if applicable, which addresses organizations under section 509(a)(2). Ensure to calculate and report the necessary public support percentage.

- If your organization qualifies as a Type III supporting organization, complete the requirements outlined in Part IV. Provide detailed information regarding your supportive relationships and any necessary documentation.

- Utilize Part VI for any supplemental information that complements responses on the form. Clearly reference the specific parts and lines you are addressing.

- Once all sections are completed, review the form for accuracy and completeness. Save your changes, and download, print, or share the form as needed.

Complete your IRS forms online today for a smoother filing experience.

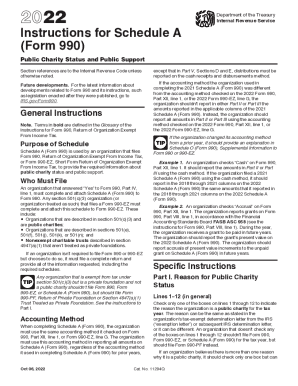

Schedule A (Form 990) is used by an organization that files Form 990, Return of Organization Exempt From Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt From Income Tax, to provide the required information about public charity status and public support.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.