Loading

Get Irs 1041 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 online

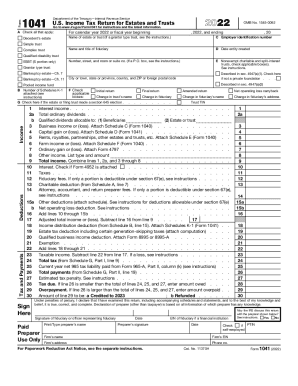

Filing the IRS Form 1041, the U.S. Income Tax Return for Estates and Trusts, is essential for fiduciaries managing estates or trusts. This guide provides comprehensive, step-by-step instructions to ensure a smooth and accurate online filing process.

Follow the steps to accurately complete the IRS 1041 online

- Click the ‘Get Form’ button to access and open the IRS Form 1041 in your preferred online editing tool.

- Begin by completing the identification section, which includes the name of the estate or trust, the employer identification number (EIN), and the fiduciary's details. Ensure that you accurately provide the creation date of the entity.

- Choose the applicable box for the type of entity, such as decedent's estate, simple trust, or complex trust. This affects tax treatment, so select carefully.

- Continue to the income section, where you will list different types of income such as interest, dividends, and business income. Be prepared to attach additional schedules if necessary.

- In the deductions section, input all allowable expenses, including fiduciary fees and charitable deductions. Follow instructions closely as some deductions may require additional calculations.

- Calculate the taxable income. This step involves subtracting your deductions from the total income to determine the final taxable amount.

- Move to the tax computations section where you will calculate the tax owed based on the taxable income. Review instructions as there are unique credits and special considerations that may apply.

- Complete the payments section, noting any estimated payments made or amounts owed. Ensure you include applicable penalties and prior year payments as necessary.

- Review the signature section, ensuring it is signed by the fiduciary or the authorized representative. This step is crucial as unsigned forms may be rejected.

- Finally, save your changes, and consider downloading or printing the completed form for your records. Follow the prompts to submit electronically as applicable.

Complete your IRS Form 1041 online today for a seamless filing experience.

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.