Loading

Get Va Dot 760 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 760 online

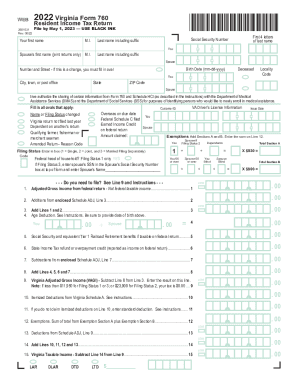

Completing the VA DoT 760 is a crucial step for residents filing their state income tax returns. This guide provides a clear and supportive walkthrough for filling out the form online, ensuring that you understand each section and field.

Follow the steps to successfully complete the VA DoT 760 online.

- Click the ‘Get Form’ button to obtain the VA DoT 760 form and open it in your preferred editor.

- Begin by entering your first name, middle initial, and last name including any suffix. If filing jointly, also include your partner's name in the respective fields.

- Provide your birth date in the format mm-dd-yyyy and enter your social security number, along with your partner's if filing jointly.

- Fill out your complete address, including number and street, city, and ZIP code. Ensure to mark the oval if this is a change of address.

- Indicate any applicable conditions by filling in the corresponding ovals, such as if you are overseas on the due date or if you filed a Federal Schedule C.

- Enter general information such as exemptions and age deductions, accurately summing Section A and B for entry on Line 12.

- Record your adjusted gross income from your federal return and any additions or subtractions as outlined in the form.

- Complete the tax computation section, calculating your taxable income based on deductions, credits, and tax rates. Ensure all numbers are rounded appropriately.

- If applicable, indicate payments made for the tax year, including withholding amounts and any overpayment credits carried forward.

- Review all sections for accuracy, ensure all required signatures and dates are included, and finalize your form. Save your changes, download a copy, and consider printing it or sharing it as needed.

Start filling out your VA DoT 760 online today for a smooth and efficient filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Complete Form 760, Lines 1 through 9, to determine your Virginia Adjusted Gross Income (VAGI). If the amount on Line 9 is less than the amount shown below for your filing status, your Virginia income tax is $0 and you are entitled to a refund of any withholding or estimated tax paid.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.