Loading

Get Ks Dor Cr-16 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS DoR CR-16 online

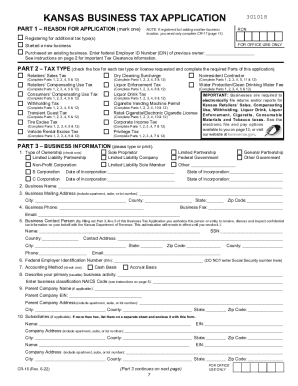

This guide provides comprehensive instructions for completing the KS DoR CR-16 application online. By following the steps outlined below, users can effectively navigate through the form, ensuring all necessary information is accurately submitted.

Follow the steps to complete the KS DoR CR-16 online.

- Press the ‘Get Form’ button to access the KS DoR CR-16 application and open it in your preferred online platform.

- In Part 1, select your reason for applying by marking the appropriate checkbox. Ensure to clearly indicate if you are registering for additional tax types, starting a new business, or purchasing an existing business.

- Proceed to Part 2, where you will check the boxes for each tax type or license you are requesting. Complete the necessary parts of the application according to the selected tax types.

- In Part 3, fill out the business information section. Type or print details such as the type of ownership, business name, mailing address, and business contact person’s information. Ensure that the Federal Employer Identification Number (EIN) is entered correctly.

- Continue to Part 4, where you must provide location information. If applicable, check whether the business location is within city limits and describe the primary business activity.

- In Part 5, indicate the date retail sales began and whether you operate more than one business location. Answer questions regarding sales and delivery of merchandise to customers in Kansas.

- Complete Part 6 to report withholding tax information, including the date payments began and estimating your annual tax amount.

- If necessary, fill in Parts 7 to 10 for corporate income tax, liquor enforcement tax, and cigarette tax, as well as any related questions specific to your business.

- In Part 11, provide details regarding your nonresident contractor registration, if applicable. Ensure all necessary financial information and project details are accurately included.

- Lastly, in Part 12, disclose ownership and include the required signatures, ensuring that all individuals listed certify that the information provided is true and complete.

- Once completed, save your changes, download the document, or print it for submission. If applicable, share the form with relevant parties as needed.

Begin filling out the KS DoR CR-16 online to ensure your business is properly registered and compliant with tax requirements.

Any amended Form 1040 and 1040-SR returns older than three years, or Form 1040-NR and 1040-SS/PR returns older than 2 years cannot be amended electronically. Amended returns for any other tax years or tax forms must be filed by paper.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.