Loading

Get Irs 1041-t 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041-T online

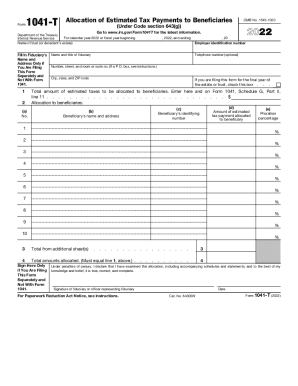

Filling out the IRS 1041-T form online can seem challenging, but with this comprehensive guide, you will navigate each section easily. This form is essential for trusts or decedent’s estates to allocate estimated tax payments to beneficiaries.

Follow the steps to fill out the IRS 1041-T form online.

- Use the 'Get Form' button to acquire the IRS 1041-T form and open it in your preferred online editor.

- Complete the identification section: Enter the name of the trust or decedent’s estate, the employer identification number, and the fiduciary’s details including name, title, and contact number, if applicable.

- Indicate the tax year by filling in the dates at the top of the form for the relevant calendar year or fiscal year.

- Check the box if you are filing this form for the final year of the estate or trust.

- Provide the total amount of estimated taxes to be allocated to beneficiaries in the designated field.

- List each beneficiary's information: their name and address, identifying number, the estimated tax payment allocated to them, and the proration percentage.

- If there are more than 10 beneficiaries, create an attached sheet following the same format as step 6 and indicate the total on line 3.

- Ensure that the total amounts allocated equal the total from line 1.

- If filing this form separately, sign and date it, confirming the accuracy and completeness of the information provided.

Start completing your IRS 1041-T form online today for efficient tax allocation.

Purpose of Form. A trust or, for its final tax year, a decedent's estate may elect under section 643(g) to have any part of its estimated tax payments (but not income tax withheld) treated as made by a beneficiary or beneficiaries. The fiduciary files Form 1041-T to make the election.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.