Loading

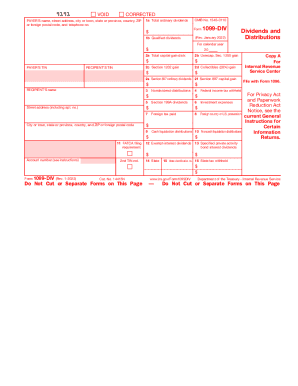

Get Irs 1099-div 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-DIV online

Filling out the IRS 1099-DIV form online is a crucial task for reporting dividend income. This user-friendly guide will walk you through the necessary steps to ensure accurate and efficient completion of the form.

Follow the steps to complete the IRS 1099-DIV form carefully.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

- Enter the payer’s information, including name, street address, city or town, state, country, ZIP code, and telephone number in the designated fields.

- Input the payer's and recipient's taxpayer identification number (TIN) in the respective boxes.

- Report total ordinary dividends in box 1a, followed by the amount of qualified dividends in box 1b.

- Fill in total capital gain distributions in box 2a and any applicable gains such as unrecaptured section 1250 gain in box 2b.

- Continue completing the form by noting any foreign taxes paid and other relevant financial information in the designated fields.

- Review all filled information for accuracy, ensuring no fields are left blank unless specified.

- Once completed, you can save changes, download, print for your records, or share the form as needed.

Start filling out your IRS 1099-DIV form online today to ensure timely and accurate reporting.

Form 1099-DIV is used by banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.