Loading

Get Ca Ftb 109 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 109 online

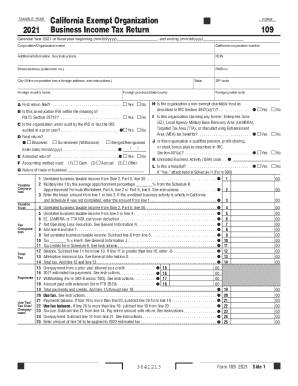

The CA FTB 109 form is a crucial document for exempt organizations in California to report their business income tax return. This guide will provide you with clear, step-by-step instructions on how to fill out the form online, ensuring you provide all necessary information correctly.

Follow the steps to complete the CA FTB 109 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable year at the top of the form, indicating whether you are reporting for a calendar year or a fiscal year by filling in the start and end dates.

- Fill in the corporation or organization name, California corporation number, and federal employer identification number (FEIN). Provide your street address, including numbers for suite or room, PMB number, city, and ensure you indicate if it's a foreign address by completing the relevant fields.

- Indicate whether this is the first return being filed by selecting 'Yes' or 'No' for the respective questions regarding education IRAs, audit status, and if it is a final return.

- Provide the accounting method used: cash, accrual, or other by checking the appropriate box.

- Describe the nature of your trade or business briefly in the designated area.

- Proceed to fill out sections related to unrelated business income and tax by providing necessary financial details as per the form's instruction sections.

- Review the form for any additional sections specific to tax credits or deductions available to the organization.

- Once all fields are completed accurately, you can save changes, download the form for your records, or print it directly from the editor.

Complete your forms online with confidence and ensure you're meeting California's requirements efficiently.

Related links form

All California LLCs or corporations that choose S Corp taxation must pay a 1.5% state franchise tax on their net income. This is paid by the business itself, not the LLC members or corporate shareholders. Also, all LLCs and S Corps must pay a minimum franchise tax of $800 annually, except for the first year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.