Loading

Get Oh Dte 1 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH DTE 1 online

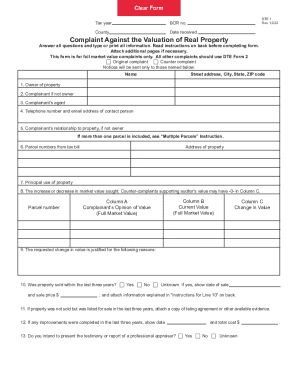

The OH DTE 1 form is essential for filing a complaint against the valuation of real property in Ohio. This guide will provide a clear and supportive step-by-step approach to filling out this form online, ensuring you can effectively present your case.

Follow the steps to effectively complete the OH DTE 1 form

- Press the ‘Get Form’ button to access the OH DTE 1 form and open it in your online document management system.

- Indicate the tax year and BOR number, as well as select the appropriate box for either an original or counter complaint.

- Fill in the name, street address, city, state, ZIP code of the owner of the property, complainant (if not the owner), and complainant’s agent, along with their contact telephone number and email address.

- If the complainant is not the property owner, provide their relationship to the property.

- Enter the parcel numbers as found on the tax bill and specify the property address.

- Detail the principal use of the property and state the increase or decrease in market value you are requesting.

- Provide your opinion of value, current value, and any change in value in the relevant columns.

- Explain the reasons justifying the requested change in value.

- Indicate whether the property has been sold within the last three years and provide the sale date and price if applicable.

- If the property was listed for sale, attach evidence such as a copy of the listing agreement.

- List any improvements made to the property in the last three years, including dates and costs.

- State whether you intend to present the testimony or report of a professional appraiser.

- If applicable, check the reasons for valuation change in relation to any previous complaints.

- Complete the declaration section, obtaining necessary signatures and dates.

- Once all fields are completed, save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your OH DTE 1 form online now to ensure your complaint is submitted on time.

Related links form

The real property conveyance fee is paid by persons who make sales of real estate or used manufactured homes. The base of the tax is the value of real estate sold or transferred from one person to another.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.