Loading

Get Oh Odt It 3 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH ODT IT 3 online

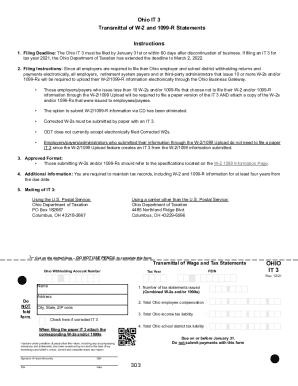

The OH ODT IT 3 form, used for the transmittal of W-2 and 1099-R statements, is an essential document for employers and payers in Ohio. This guide provides comprehensive instructions to assist users in accurately completing the form online.

Follow the steps to complete the OH ODT IT 3 form online.

- Click ‘Get Form’ button to obtain the OH ODT IT 3 form and open it in the online editor.

- Enter your Ohio withholding account number in the designated field. This is essential for identifying your business in relation to taxes.

- Provide your name and address in the corresponding sections. Clearly fill in the city, state, and ZIP code to ensure precise documentation.

- Input your Federal Employer Identification Number (FEIN) accurately in the space provided, as this number uniquely identifies your business.

- Specify the tax year for which you are filing the form. This helps to align the tax filings with corresponding records.

- Complete Section 1 with the number of tax statements issued, which is the combined total of W-2s and/or 1099s, ensuring an accurate count.

- In Section 2, report the total Ohio employee compensation, ensuring that you include all relevant details. Double-check your calculations for accuracy.

- Fill out Section 3 with the total Ohio income tax liability. This should reflect your calculated tax responsibilities accurately.

- Complete Section 4 by reporting the total Ohio school district tax liability, ensuring this figure is carefully calculated.

- If applicable, check the box indicating that this is a corrected IT 3. Remember to attach the corresponding W-2s and/or 1099s if filing a paper return.

- Sign the form in the designated area, providing your Social Security Number (SSN), title, and date. Ensure that the signature is from a responsible party.

- Review the filled form thoroughly to confirm all information is true and complete, as inaccuracies may lead to penalties. Once satisfied, save your changes, and proceed to download or print the form as needed.

Complete your OH ODT IT 3 form online today to ensure timely compliance with Ohio tax regulations.

Effective January 1, 2022, employers must withhold municipal income taxes where an employee's work is actually performed, for each portion of a day worked in any taxing municipality where the employee performs services for the employer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.