Loading

Get Ca Ftb 568 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 568 online

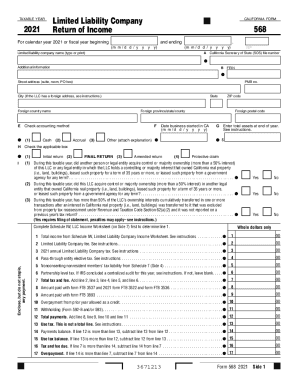

The California Form 568 is essential for limited liability companies (LLCs) to report their income and calculate taxes owed to the state. This guide will provide you with clear, step-by-step instructions on how to complete the form online, ensuring you meet all necessary requirements efficiently.

Follow the steps to fill out the CA FTB 568 online successfully.

- Click the ‘Get Form’ button to obtain the CA FTB 568 and open it in the editor.

- Begin by entering the taxable year at the top of the form, indicating whether it is for the calendar year or a fiscal year.

- Provide your California Secretary of State (SOS) file number and the name of your LLC in the designated fields. Make sure this is clear and accurate.

- Fill in the federal employer identification number (FEIN), street address, city, state, and ZIP code for your LLC.

- Indicate if this is your initial return, a final return, an amended return, or a protective claim by checking the appropriate box.

- Report your accounting method, choosing from cash, accrual, or other, and enter the date the business started in California.

- Enter the total assets at the end of the year. Ensure that this figure correlates with your financial statements.

- Answer the questions regarding control or ownership changes and partnerships, indicating yes or no as applicable.

- Calculate and report your limited liability company fee based on the guidelines provided.

- Proceed to list all applicable deductions and credits as specified in the form, ensuring that all amounts align with your financial records.

- At the end of the form, review all your entries for accuracy before deciding to save your changes, or if preferred, download, print, or share the completed form.

Complete your CA FTB 568 online to ensure compliance with California tax regulations.

Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. LLCs classified as a disregarded entity or partnership are required to file Form 568 along with Form 3522 with the Franchise Tax Board of California.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.