Loading

Get Irs 2350 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2350 online

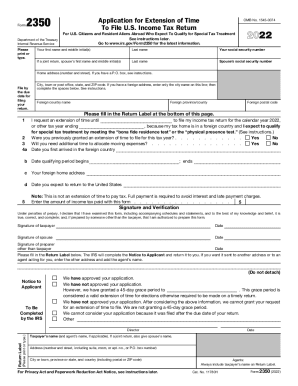

Filling out the IRS 2350 form online can simplify your tax filing process, especially for U.S. citizens and resident aliens abroad. This guide provides clear, step-by-step instructions to assist you in completing the application for an extension of time to file your income tax return.

Follow the steps to successfully complete the IRS 2350 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your first name, middle initial(s), and last name in the respective fields. Then enter your social security number. If filing a joint return, include your spouse’s name and social security number.

- Provide your home address, including the city, state, and ZIP code. If you have a foreign address, enter only the city name and complete the additional fields for country, province/county, and postal code.

- Indicate the tax year you are applying for an extension and specify the date until which you are requesting an extension due to your home being in a foreign country. Ensure you state whether you expect to qualify for the bona fide residence test or the physical presence test.

- Answer the questions regarding previous extensions and whether you will need additional time to allocate moving expenses. Provide the date of your first arrival in the foreign country, and detail the qualifying period along with your current foreign home address.

- Sign and date the form, ensuring that if you are filing jointly, both partners sign. If someone else prepared the form, that individual must sign as well.

- Complete the Return Label at the bottom of the page, ensuring it is filled out accurately, as it will be used for communication from the IRS.

- Review all entered information for accuracy. Save any changes made to the form, and download or print a copy for your records.

- Once completed, follow the instructions for submission. If filing electronically, do not send a paper copy. If submitting by mail, ensure it is sent to the correct IRS address.

Complete your IRS 2350 form online for a smoother tax filing experience.

Anybody — even people above the income threshold — can use Free File to file an extension online. Internal Revenue Service. Free File: Everyone Can File an Extension for Free. Tax software: If you're planning to use tax software, most providers support filing Form 4868 for tax extensions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.