Loading

Get La R-19026 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA R-19026 online

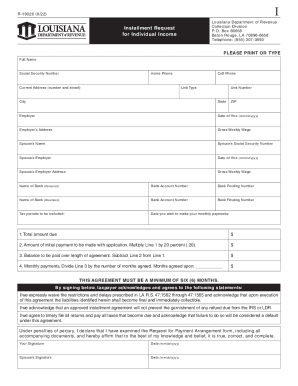

Completing the LA R-19026 online can greatly assist individuals who need to request an installment agreement for their individual income tax. This guide will provide a step-by-step approach to ensure users fill out the form correctly and efficiently.

Follow the steps to successfully complete the LA R-19026 form.

- Press the ‘Get Form’ button to access the LA R-19026 form and open it in your preferred digital platform.

- Begin filling out your personal information, including your full name, social security number, home phone number, current address, and cell phone number.

- Provide information about your employer, including the employer's name, date of hire, and their address, along with your gross weekly wage.

- If applicable, fill out your spouse's information, including their name, social security number, employer details, and gross weekly wage.

- Enter your banking details for automatic payments by including the names of your banks, account numbers, and routing numbers.

- Indicate the tax periods you are requesting to include and the date you wish to start your monthly payments.

- Calculate the total amount due, the initial payment (20 percent of the total), the remaining balance, and the monthly payment amount over the agreed period, ensuring the agreement lasts a minimum of six months.

- Read and acknowledge the statements regarding filing responsibilities, garnishments, and the agreement terms. Sign and date the form accordingly.

- If you are using automatic bank debit, complete that section with the required signatures and include a voided check as required.

- Review the completed form for accuracy and clarity. Save your changes, and when ready, proceed to download, print, or share the form as necessary.

Complete your documents online today for a smooth and efficient filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Louisiana State Offer in Compromise: How to Pay Less. The Louisiana Department of Revenue (LDR) has the ability to settle state tax liabilities up to $500,000 for less than you owe. The LDR will only settle tax bills when there is serious doubt of liability or doubt of collectibility.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.