Loading

Get Irs 1040 - Schedule 1 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule 1 online

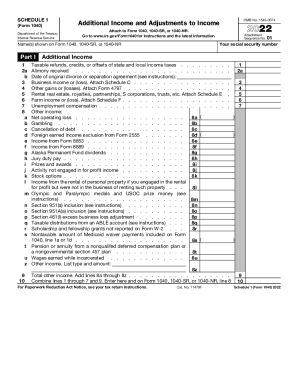

Filling out the IRS 1040 - Schedule 1 is an important step in the tax filing process for individuals reporting additional income and adjustments to income. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete your IRS 1040 - Schedule 1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your social security number at the top of the form. Ensure this information is accurate as it links to your tax records.

- Provide your name(s) as shown on Form 1040, 1040-SR, or 1040-NR. This should match exactly with the information submitted on your main tax return.

- In Part I, report any additional income you have received. Start with taxable refunds, credits, or offsets of state and local income taxes on line 1.

- Continue to line 2 for alimony received, providing the date of the original divorce or separation agreement.

- For business income or loss, refer to Schedule C and enter the figures on line 3.

- For other gains or losses, attach Form 4797 and enter the amount on line 4.

- Rental income or losses should be reported on line 5, requiring attachment of Schedule E.

- For farm income or losses, include the information on line 6 with an attached Schedule F.

- On line 7, report unemployment compensation if applicable.

- Line 8 allows for various types of other income. Specify type and amount for each applicable section from lines 8a to 8z.

- Once all fields of Part I are completed, add up the amounts from lines 1 through 7 and line 9 to get the total on line 10. This total follows to your main 1040 form.

- In Part II, you will enter adjustments to income beginning with educator expenses on line 11. Provide the amount spent on eligible educational supplies.

- Proceed through each adjustment line, providing necessary documentation where asked, such as attaching Form 2106 for certain business expenses on line 12.

- Complete lines 13 to 23 with applicable deductions and adjustments, leading to total adjustments calculated by adding lines 11 through 23 and entering that amount on line 25.

- Review the entire form for accuracy, ensuring all entries are correct.

- Once you have completed filling out the form, save your changes, and download or print a copy for your records. Ensure this Schedule 1 is attached to your Form 1040, 1040-SR, or 1040-NR before submission.

Complete your IRS 1040 - Schedule 1 online today to ensure a smooth filing process.

What is IRS Form Schedule 2? Form 1040 Schedule 2 includes two parts: "Tax" and "Other Taxes." Taxpayers who need to complete this form include: High-income taxpayers who owe alternative minimum tax (AMT) Taxpayers who need to repay a portion of a tax credit for the health insurance marketplace.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.