Loading

Get Irs 990 - Schedule K 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS 990 - Schedule K online

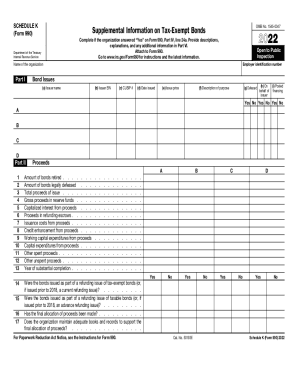

The IRS 990 - Schedule K is a critical form for organizations that have issued tax-exempt bonds. This guide provides step-by-step instructions to assist you in accurately completing this form online while ensuring compliance with IRS requirements.

Follow the steps to effectively complete Schedule K.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employer identification number and the name of the organization at the top of the form. This information identifies your entity and is crucial for proper filing.

- In Part I, provide detailed information about the bond issue, including the issuer's name, EIN, CUSIP number, date issued, and purpose. Make sure each field is filled accurately.

- Proceed to Part II to report the proceeds from the bond issue. This includes filling out various fields related to amounts such as bonds retired, legally defeased, and total proceeds, among others. Ensure that the figures accurately reflect your organization’s financials.

- Move on to Part III to address any private business use of the bond-financed property. Answer all relevant questions thoroughly, including the nature of partnerships or lease arrangements.

- In Part IV, review the arbitrage requirements, indicating whether forms have been filed and if certain exceptions apply. This section ensures compliance with specific IRS regulations.

- Finally, in Part V, confirm if your organization has established written procedures for corrective actions related to federal tax requirements. This is important for regulatory compliance.

- Use Part VI to provide any additional information or explanations for answers given in previous sections. This part allows for any necessary clarifications.

- Once all sections are complete, review the entire form for accuracy. Save your changes, and finalize your document by downloading, printing, or sharing it as necessary.

Complete your IRS 990 - Schedule K online to ensure compliance and accurate reporting.

If your partnership reported excess business interest expense in Box 13, Code K of your 1065 Schedule K-1, you are required to file Form 8990. Per Partner's Instructions for Schedule K-1 (Form 1065) Partner's Share of Income, Deductions, Credits, etc.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.