Loading

Get Ca Ftb 592-b 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

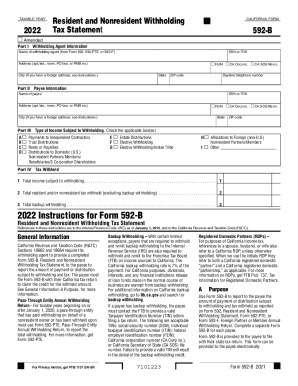

How to fill out the CA FTB 592-B online

This guide provides clear instructions on how to complete the CA FTB 592-B form online. Whether you are an experienced user or new to digital document management, this comprehensive guide will lead you through each section and component of the form.

Follow the steps to complete your CA FTB 592-B accurately.

- Click 'Get Form' button to obtain the form and open it in your preferred editor.

- Fill in the withholding agent information in Part I, including the name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and relevant address details. Make sure to include a daytime telephone number for any follow-up.

- Proceed to Part II to enter payee information. Input the payee's name and SSN or ITIN, and provide their address details. If applicable, ensure to follow the right procedure for grantor or nongrantor trusts.

- In Part III, identify the type of income subject to withholding by checking the appropriate box(es) that reflect the income types relevant to your situation.

- Move to Part IV to report the tax withheld. For Line 1, enter the total income subject to withholding. In Line 2, provide the total resident and/or nonresident tax withheld, ensuring the calculations align with applicable tax rates. If any backup withholding applies, include that amount in Line 3.

- Review all information entered to ensure it is complete and accurate, making corrections as necessary.

- Once completed, you can save your changes, download, print, or share the form as needed.

Complete your CA FTB 592-B form online today to ensure compliant tax reporting.

Purpose. Use Form 593: Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. Estimate the amount of the seller's/transferor's loss or zero gain for withholding purposes and to calculate an alternative withholding calculation amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.