Loading

Get Irs 1040 - Schedule 3 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule 3 online

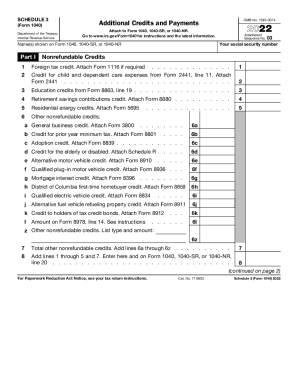

Filling out the IRS 1040 - Schedule 3 is an important step for users looking to report additional credits and payments on their tax returns. This guide provides clear, step-by-step instructions to make the process of completing this form online straightforward and manageable for everyone.

Follow the steps to fill out the IRS 1040 - Schedule 3

- Select the ‘Get Form’ button to access the IRS 1040 - Schedule 3 online form and open it in your document management system.

- Enter your social security number in the designated field at the top of the form.

- Provide the name(s) as shown on your Form 1040, 1040-SR, or 1040-NR in the corresponding section.

- Proceed to Part I, where you will report nonrefundable credits. Fill in the appropriate credits by referencing the tax forms indicated for each line, such as the foreign tax credit, child and dependent care expenses, education credits, and any other relevant credits.

- If applicable, for lines 6a through 6z, detail any other nonrefundable credits, ensuring to attach the necessary forms as instructed.

- Add all applicable nonrefundable credits from lines 1 through 5 and the total from line 7. Enter the total on Form 1040, 1040-SR, or 1040-NR, line 20.

- Move to Part II to report other payments and refundable credits. Fill in any credits or payments, including the net premium tax credit, social security tax withheld, and other relevant entries.

- Sum the amounts from lines 9 through 12 and line 14 to document total other payments or refundable credits, entering the total on Form 1040, 1040-SR, or 1040-NR, line 31.

- Review all entries for accuracy. When completed, you can download, print, or share the form as necessary, making sure to save any changes made.

Complete your documents online seamlessly today!

File Form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: You are an individual, estate, or trust; and. You paid or accrued certain foreign taxes to a foreign country or U.S. possession.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.