Loading

Get Irs 8853 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8853 online

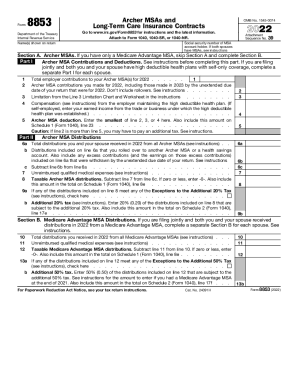

The IRS 8853 form is utilized for reporting Archer Medical Savings Accounts (MSAs) and Long-Term Care Insurance Contracts. This guide will provide you with clear step-by-step instructions to help you complete the form accurately online.

Follow the steps to complete your IRS 8853 form online.

- Click ‘Get Form’ button to obtain the IRS 8853 form and open it in your preferred editing tool.

- Begin with filling in the name(s) shown on the return along with the social security number of the MSA account holder. If both partners have MSAs, follow the specific instructions provided in the form.

- Proceed to Section A for Archer MSAs. If you only have a Medicare Advantage MSA, skip to Section B.

- Continue with Part II of Section A to report Archer MSA distributions. Total distributions received, report unreimbursed qualified medical expenses, and calculate any taxable distributions. Be sure to check for any conditions that might exempt you from additional taxes.

- Move on to Section B if applicable, which addresses Medicare Advantage MSA distributions. Again, if both you and your partner received distributions, complete this section separately for each.

- If necessary, complete Section C for Long-Term Care (LTC) Insurance Contracts. Provide details as requested, ensuring compliance with filing requirements, and differentiate amounts received under various qualifying conditions.

- Review all entries for accuracy. Once all sections are populated correctly, you can save your changes, download, print, or share the form as needed.

Complete your IRS 8853 form online today to ensure timely filing and compliance with tax regulations.

Use Form 8853 to: Report Archer MSA contributions (including employer contributions. Figure your Archer MSA deduction. Report distributions from Archer MSAs or Medicare Advantage MSAs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.