Loading

Get Oh Cca Form 120-16-ir 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH CCA Form 120-16-IR online

This guide provides a clear and supportive walkthrough for users on how to complete the OH CCA Form 120-16-IR online. Whether you have experience with legal forms or are a first-time user, this guide is designed to help you navigate each step confidently.

Follow the steps to complete the OH CCA Form 120-16-IR online.

- Click the ‘Get Form’ button to access the OH CCA Form 120-16-IR. This action will allow you to open the form in an editable format.

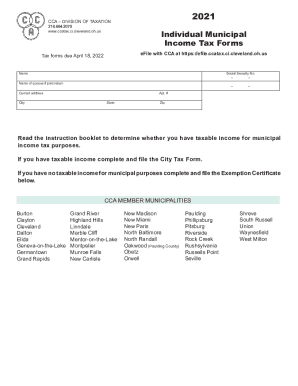

- Begin filling out your personal information. Enter your name and Social Security number accurately. If you are filing a joint return, include your spouse's name.

- Provide your current address, including apartment number (if applicable), city, state, and zip code.

- Review the tax exemption sections. Indicate if you live in a mandatory filing community and check the appropriate boxes if claiming any exemptions such as retirement income or no earned income.

- Fill out the income sections, entering total wages and other applicable income, such as business or rental income. Make sure to attach W-2s or 1099s as indicated.

- Complete the tax calculations based on the guidance provided in the form. Ensure that all figures are accurate and reflect your financial situation.

- Sign and date the form at the designated areas. If filing jointly, ensure that your spouse also signs.

- Finally, save your changes, and you have the option to download, print, or share the completed form as needed.

Complete your documents online now!

1120C Corporations, Subchapter S Corporations, and Partnerships, including LLC's and REIT's doing business in our area are required to file the Net Profit form. Trusts with rental in a CCA community are required to file a CCA Net Profit form. However, trusts having only intangible income do not file with CCA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.