Loading

Get Irs 433-d (sp) 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 433-D (SP) online

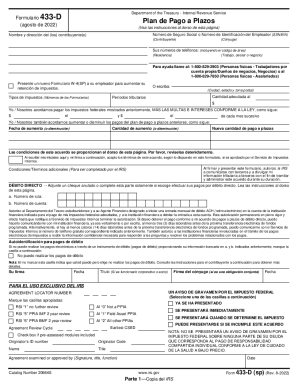

Filling out the IRS 433-D (SP) form online can streamline the process of setting up a payment plan for federal taxes owed. This guide provides a comprehensive, step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to effectively complete the form online.

- Use the ‘Get Form’ button to access the form and open it in your preferred editor.

- Fill in your Social Security Number or Employer Identification Number (SSN/EIN) at the top of the form.

- Enter your name and address information clearly, including the name of your partner if this is a joint tax obligation.

- Provide your current phone numbers, including area codes, for both residence and work.

- List the type of taxes owed by identifying the associated form numbers.

- Indicate the total amount due and detail the periods for which the taxes are owed.

- Agree to the payment terms by specifying the amount you will pay each month and the dates you would like these payments to begin.

- If applicable, specify any changes to previous payment plans and outline the new payment amounts.

- Initial the indicated section to acknowledge understanding and acceptance of the agreement terms.

- Sign and date the form, and include any necessary partner or spokesperson signatures if applicable.

- If you opt for direct debit payments, complete the routing and account number sections accurately.

- Review the conditions of the agreement on the back of the form before submission.

- Finally, save your changes, then download, print, or share the completed form as needed for submission.

Complete your IRS 433-D (SP) form online today to manage your tax obligations effectively.

0:00 1:22 How to Fill Out an IRS Form 433 D - YouTube YouTube Start of suggested clip End of suggested clip Next print out the resulting document. Share it with anybody via email fax sms usps or shareable.MoreNext print out the resulting document. Share it with anybody via email fax sms usps or shareable. Link send it out for signature.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.