Loading

Get Irs 8615 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8615 online

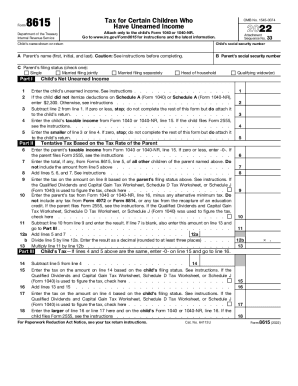

Filling out the IRS Form 8615, which assesses taxes for certain children with unearned income, can be a straightforward process with the right guidance. This comprehensive guide provides clear instructions to help users navigate the online form efficiently and accurately.

Follow the steps to complete the IRS 8615 online

- Click ‘Get Form’ button to obtain the IRS Form 8615 and open it in the editor.

- Carefully enter the child's name and social security number as shown on their tax return.

- Input the parent's name, including first name, initial, and last name, and their social security number.

- Select the parent's filing status by checking the appropriate box for 'Single,' 'Married filing separately,' 'Head of household,' 'Married filing jointly,' or 'Qualifying widow(er).'.

- In Part I, enter the child's unearned income in line 1, and follow the instructions regarding whether they itemized deductions.

- Subtract line 2 from line 1; if this number is zero or less, you do not need to complete the form further but must attach it to the child’s return.

- Complete line 4 by entering the child’s taxable income from their Form 1040 or 1040-NR.

- Take the smaller of line 3 or line 4 for line 5; if zero, again, stop, and attach this form.

- In Part II, enter the parent’s taxable income from their Form 1040 or 1040-NR in line 6.

- If there are any other children, input the totals from Forms 8615 in line 7.

- Add lines 5, 6, and 7 into line 8, and follow instructions to enter the corresponding tax based on the parent's filing status in lines 9 and 10.

- Complete the calculations and comparisons for lines 11 through 15 to determine the child’s tax.

- Finally, enter the larger figure from lines 16 or 17 on the appropriate line of the child's Form 1040 or 1040-NR.

Complete your documents online for a smoother tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

File Form 8949 with the Schedule D for the return you are filing. This includes Schedule D of Forms 1040, 1040-SR, 1041, 1065, 8865, 1120, 1120-S, 1120-C, 1120-F, 1120-FSC, 1120-H, 1120-IC-DISC, 1120-L, 1120-ND, 1120-PC, 1120-POL, 1120-REIT, 1120-RIC, and 1120-SF; and certain Forms 990-T.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.