Loading

Get Oh Rita 17 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH RITA 17 online

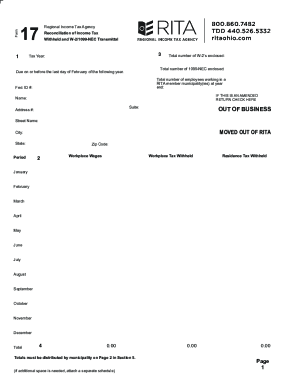

Filling out the OH RITA 17 form online is a straightforward process that helps ensure proper reconciliation of income tax withheld and reporting of W-2/1099-NEC transmittals. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the OH RITA 17 online.

- Press the ‘Get Form’ button to access the OH RITA 17 form and open it in the online editor.

- Enter the tax year for which you are reporting in the designated field at the top of the form.

- Indicate the total number of W-2 forms you are enclosing by entering the number in the appropriate field.

- Fill out the total number of 1099-NEC forms you are including by entering this number in the next field.

- Provide the total number of employees working in a RITA member municipality at year-end.

- Enter your Federal Identification Number (Fed. ID #) in the specified area to ensure proper identification.

- If this is an amended return, check the box provided.

- Complete the name and address fields, ensuring all information is accurate and up-to-date.

- Report workplace wages and tax withheld for each month of the year by filling in the respective sections.

- Use the provided space to distribute totals by municipality on Page 2 in Section 5.

- If you require additional space for reporting, attach a separate schedule as necessary.

- At the end of the form, confirm all numbers are entered correctly and consistent across sections.

- Save your changes or download the completed form for your records. You can also print or share the form as needed.

Complete your documents online now for a streamlined and efficient filing process.

Form 17 - Domestic Relations Form - Petition for Dissolution of Marriage and Waiver of Service of Summons, Ohio Civ.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.