Get La R-10606 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA R-10606 online

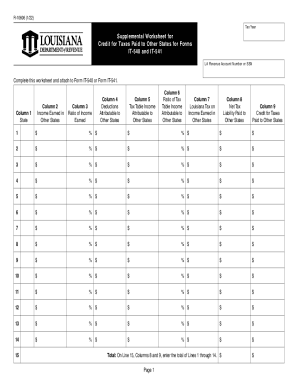

This guide provides users with a step-by-step approach to filling out the LA R-10606 form online. By following these clear instructions, you will be able to accurately complete the supplemental worksheet for credit for taxes paid to other states.

Follow the steps to complete the LA R-10606 form effectively.

- Press the ‘Get Form’ button to access and open the LA R-10606 in the online editor.

- In Column 1, enter the abbreviation for the state where you earned income. Make sure to use the correct state codes.

- In Column 2, input the income earned in the other states. This figure should come from the income tax return filed with that state. Note the limitations based on your current form (IT-540 or IT-541).

- Calculate the ratio of income earned by dividing the amount in Column 2 by the total income reported on the appropriate line of your Louisiana tax form. Enter this percentage in Column 3, rounding to two decimal places.

- In Column 4, determine the deductions attributable to other states. Multiply the total deductions claimed by the percentage calculated in Column 3 and enter the result.

- Subtract the amount in Column 4 from the income in Column 2 to find the taxable income for other states. Enter this in Column 5.

- For Column 6, find the ratio of your tax table income attributable to the other states. Divide the amount in Column 5 by the total tax table income reported on your Louisiana tax form and round to two decimal places.

- In Column 7, calculate the Louisiana tax on the income earned in other states by multiplying the percentage in Column 6 by your Louisiana income tax, rounding to the nearest dollar.

- In Column 8, enter the net tax liability as reported on the return from the other state. Ensure that this value does not come from standard forms like W-2 or 1099.

- In Column 9, for each line, enter the lesser value between Column 7 and Column 8. Sum the totals from lines 1 through 14 and record this value on Line 15 of Column 9.

- Finally, review your completed information for accuracy. Save your changes, download a copy of the form, and print it if necessary, or share it as required.

Complete your LA R-10606 form online today and ensure accurate reporting of your taxes.

Federal Self-Employment Tax It applies to all the earnings you withdraw from your business. The current self-employment tax rate is 15.3 percent.

Fill LA R-10606

Supplemental Worksheet for Credit for Taxes. Supplemental Worksheet for. 10606 January 01, 2021 December 31, 2021. The LA R10606 instructions say: "Enter the income taxable to the other state that is taxable to Louisiana. I need to attached form R10606 along with the Nonresident CA return in order to file LA state. I can't find that form in Proseries, Any suggestions. Louisiana Supplemental Worksheet for Credit for Taxes Paid to Other States. Louisiana Supplemental Worksheet for Credit for Taxes Paid to Other States. Vila Leonor - Cód. 10608. The objective is to identify the main requirements and design a science and technologybased preincubation environment at the university level.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.