Loading

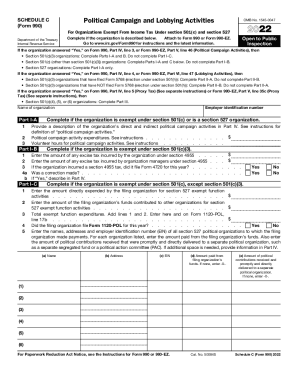

Get Irs 990 Or 990-ez - Schedule C 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS 990 Or 990-EZ - Schedule C online

Filling out the IRS 990 or 990-EZ - Schedule C can seem challenging, but with the right guidance, you can navigate the process smoothly. This form is essential for organizations exempt from income tax under specific sections, especially those involved in political campaigning and lobbying activities.

Follow the steps to complete your IRS 990 Or 990-EZ - Schedule C online.

- Click ‘Get Form’ button to obtain the form and open it in your editing interface.

- Begin by entering the name of your organization at the top of the form, as required.

- If your organization answered ‘Yes’ on the part indicating involvement in political campaign activities, complete the relevant sections based on your organization’s tax-exempt status.

- For 501(c)(3) organizations, complete Parts I-A and B for political campaign activities, leaving Part I-C blank.

- For other 501(c) organizations, complete Parts I-A and C, while leaving Part I-B blank.

- If you answered ‘Yes’ about lobbying activities, follow the instructions specific to 501(c)(3) organizations that have or have not filed Form 5768, completing the appropriate parts as needed.

- In Part I-A, detail any excise tax incurred under section 4955 and provide information on corrections made, if applicable.

- In Part I-C, if applicable, provide a description of the organization’s political campaign activities alongside the required financial information.

- Proceed to Part II-A or II-B based on whether your organization has filed Form 5768, detailing lobbying activities and expenditures as required.

- If your organization is categorized under section 501(c)(4), (5), or (6), proceed to complete Parts III-A and III-B, providing all necessary financial details.

- Finally, complete Part IV with any supplemental information required, ensuring clarity and accuracy.

- Once all fields are completed, save changes, download, print, or share your completed form as needed.

Start filling out your IRS 990 or 990-EZ - Schedule C online today for a streamlined filing experience.

The IRS Form 990 instructions provide general guidance on completing these portions of the return. Object expenses (e.g., salaries and rent) are required to be classified in three functional expense categories - (1) program services, (2) management and general, and (3) fundraising.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.