Loading

Get La Dor Cift-401w 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA DoR CIFT-401W online

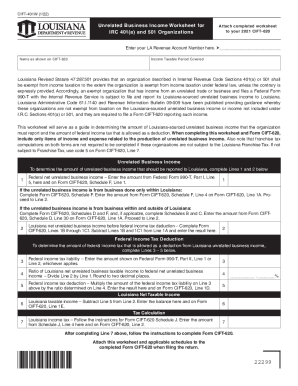

The LA DoR CIFT-401W is an essential worksheet for organizations described in Internal Revenue Code Sections 401(a) and 501. This guide will provide a clear, step-by-step approach to assist you in accurately completing the form online, ensuring compliance with state regulations.

Follow the steps to complete the LA DoR CIFT-401W online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your LA Revenue Account Number in the designated space. This information is necessary for proper identification and processing of your submitted form.

- Provide the name as shown on the CIFT-620 form to ensure consistency and correct association between documents.

- State the income tax period that this worksheet covers. Make sure it aligns with the corresponding CIFT-620 for accurate reporting.

- Determine your federal net unrelated business income and enter it in Line 1. This figure should be derived from Federal Form 990-T, Part I, Line 5.

- For unrelated business income generated solely within Louisiana, complete Schedule F on the CIFT-620 and transfer the necessary figures to Line 1A. If income is from both Louisiana and other areas, follow the instructions to complete Schedules D and F as indicated.

- Calculate the Louisiana net unrelated business income before federal income tax deduction. Complete Lines 1B through 1C1 on the CIFT-620 and record the result on Line 2 of your worksheet.

- To establish your federal income tax deduction, enter the federal income tax liability from Federal Form 990-T, Part II, either Line 1 or Line 2, on Line 3.

- Calculate the ratio of Louisiana net unrelated business taxable income to federal net unrelated business income by dividing Line 2 by Line 1. Round your result to two decimal places.

- Calculate the federal income tax deduction by multiplying the amount from Line 3 by the ratio from Line 4, and enter that amount on Line 5.

- Subtract the federal income tax deduction found in Line 5 from the Louisiana net unrelated business income on Line 2 to obtain the Louisiana taxable income for Line 6.

- Follow the instructions for completing Form CIFT-620 Schedule J to determine your Louisiana income tax, then enter this amount on Line 7.

- After finishing the calculations and filling out all relevant fields, save your changes, and download or print the completed form. Ensure to attach the worksheet and any required schedules to the CIFT-620 when filing.

Complete your documents online today for timely and compliant submissions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Corporation Income and Franchise Tax The new tax rates are 3.5% on the first $50,000 of net income, 5.5% on the next $100,000 of net income, and 7.5% on the excess over $150,000. Also, some provisions of Act 389 of the 2021 Regular Session of the Louisiana Legislature became effective.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.