Loading

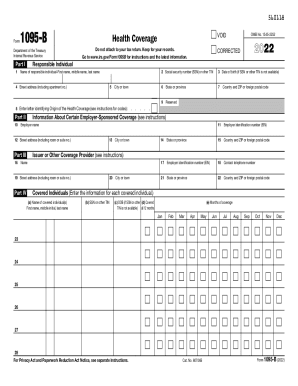

Get 1095-b2020.pdf - 560118 Form 1095-b 1 Do Not Attach To Your Tax Return ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1095-B2020.pdf - 560118 Form 1095-B online

Filling out the 1095-B form is an important step in reporting your health coverage information for tax purposes. This guide will walk you through each section of the form to ensure you complete it correctly and efficiently online.

Follow the steps to effectively complete the 1095-B form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- In Part I, provide your personal information. Enter your social security number (SSN) or taxpayer identification number (TIN) in line 2. If you do not have an SSN or TIN, fill in the date of birth on line 3.

- In Part II, complete the information regarding employer-sponsored coverage if applicable. Lines 10 to 15 should be filled out if you had coverage through an employer. If this section is blank, you can leave it as is.

- Proceed to Part III to report information about the coverage provider. Fill in the provider’s name and address as instructed in lines 16 to 22. Ensure to include a contact telephone number in line 18 if available.

- Part IV is for listing the individuals covered under the policy. For each covered individual, start with line 23, filling out their name, SSN (if applicable), and date of birth if no SSN is provided.

- Lastly, review all entries for accuracy. Once completed, save your changes, download a copy of the form, and print or share it as necessary for your records.

Complete your documents online today for a smoother filing process.

Health care coverage documents You are not required to send the IRS information forms or other proof of health care coverage when filing your tax return. However, it's a good idea to keep these records on hand. This documentation includes: Form 1095 information forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.