Loading

Get Irs 8992 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8992 online

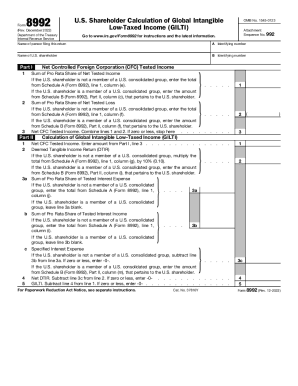

The IRS 8992 is an essential form for U.S. shareholders to calculate their Global Intangible Low-Taxed Income (GILTI). This guide provides a step-by-step approach to completing the form online, ensuring accuracy and compliance with IRS requirements.

Follow the steps to successfully complete the IRS 8992 online.

- Select the ‘Get Form’ button to access the IRS 8992. This will allow you to retrieve the form and open it for editing.

- Begin filling out the form by providing the name of the person who is filing this return and their identifying number. This information is crucial for processing your submission.

- Next, input the name of the U.S. shareholder and their identifying number. Ensure this data matches your official records.

- In Part I, calculate the Net Controlled Foreign Corporation (CFC) Tested Income by determining the sum of Pro Rata Share of Net Tested Income. Depending on your affiliation with a U.S. consolidated group, use the appropriate Schedule A or Schedule B figures.

- For line 2 of Part I, calculate the Sum of Pro Rata Share of Net Tested Loss similarly, referencing Schedule A or Schedule B as necessary.

- Combine the figures from lines 1 and 2 to determine the Net CFC Tested Income. If the result is zero or less, you may stop here.

- Move to Part II and input the Net CFC Tested Income in line 1. Follow this by entering the Deemed Tangible Income Return (DTIR) based on the specified criteria for your group status.

- Complete the calculations for lines 3a and 3b regarding Pro Rata Share of Tested Interest Expense and Income, respectively, being mindful of your group status.

- Subtract the Specified Interest Expense from the DTIR to determine the Net DTIR. If the result is zero or less, enter -0-.

- Finally, calculate the GILTI by subtracting the Net DTIR from the Net CFC Tested Income. Ensure accuracy before finalizing the calculations.

- Once you have filled out the form completely, you can save changes, download, print, or share the IRS 8992 as needed.

Complete your IRS 8992 online today to ensure timely and accurate filing.

GILTI is calculated as the total active income earned by a US firm's foreign affiliates that exceeds 10 percent of the firm's depreciable tangible property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.