Loading

Get Irs 8865 - Schedule K-1 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8865 - Schedule K-1 online

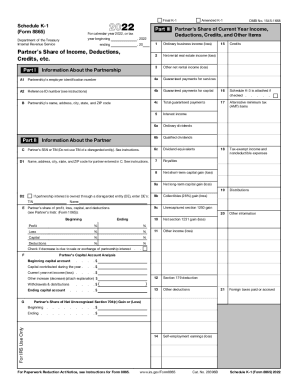

The IRS 8865 - Schedule K-1 is a vital form for partners in certain partnerships, describing their share of income, deductions, and credits. This guide will provide clear, step-by-step instructions for filling out this form online, ensuring you can navigate the process with confidence.

Follow the steps to complete your IRS 8865 - Schedule K-1 online.

- Click the ‘Get Form’ button to access the IRS 8865 - Schedule K-1 form online.

- In Part I, enter the information about the partnership. Include the partnership’s name, address, and employer identification number.

- Fill out Part II with the partner's information. Provide the partner’s name, address, and Social Security Number or Tax Identification Number.

- In Part III, report the partner's share of income, deductions, credits, and other items. Input the appropriate figures for ordinary business income, rental income, interest income, and so forth.

- Ensure you accurately complete sections regarding distributions and any other deductions, making sure to refer to the instructions for specific details.

- Review all entered information for accuracy before proceeding to save, download, print, or share the completed form.

Complete your IRS 8865 - Schedule K-1 online to ensure accurate reporting of your partnership information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.